As the financial markets continue to evolve, the relevance of sound risk management remains constant. It is the cornerstone for not just preserving capital, but also realizing gains in any Trading Strategies. From Stock Trading Methods to Cryptocurrency Trading Tactics, risk management serves as a critical factor that underscores success and sustainability.

Trading strategies are integral to this process as they provide a structured approach to navigate the unpredictable terrains of the market. Swing Trading Techniques, Day Trading Tactics, or Equity Trading Strategies all encapsulate a unique set of rules and guidelines to follow, allowing traders to reduce guesswork and speculate with greater precision.

However, the application of trading methods lacks efficacy without a solid risk management foundation. Algorithmic Trading Strategies or High-Frequency Trading methods may grant traders an edge, but it is risk management that determines the longevity of their market participation. The interplay between trading strategy and risk regulation forms a complex yet illuminating aspect of modern financial systems. It is a dance that neither follows a rigid formula nor allows for whimsical steps, and one that often separates successful traders from the rest.

Discussion on Risk Management Principles within Trading

Principles and Methodologies of Risk Management

Key to successful trading, be it Forex Trading Plans or Equity Trading Strategies, is the application of sound Risk Management Principles. These principles primarily aim to quantify and mitigate loss potential and assist traders in informed decision-making.

Among these methodologies is the use of stop losses, a tool to limit the potential downside of a trade. Traders implementing Day Trading Tactics or Swing Trading Techniques often use stop-loss orders to prevent substantial losses beyond a pre-determined level. Another commonly applied methodology is position sizing, where the size of a position is determined by the level of risk accepted by the trader. Options Trading Methods and Stock Trading Methods often incorporate these risk management approaches.

The Role and Importance of Risk Management in Maintaining a Profitable Trading Strategy

Risk management is not just a protective mechanism against potential losses; it is, in fact, an indispensable component of building Profitable Trading Plans. From the dynamic Financial Markets Analysis to niche Cryptocurrency Trading Tactics, applying meticulous risk management is pivotal to long-term trading success.

Without proper risk management, even the most advance Algorithmic Trading Strategies or High-Frequency Trading methods can lead to drastic capital depletion. A simple shift in market trends can transform a profitable position into a losing one. Therefore, successful traders understand the importance of effectively managing risk in congruity with their Market Trend Analysis and Technical Analysis Techniques.

Risk management also promotes discipline among traders and fosters a structured trading approach. One of the critical risk management approaches in Commodity Trading Strategies, for instance, is to not risk a significant percentage of capital on a single trade. Such practices support consistency in returns and shield the trader from volatile market scenarios. Thus, risk management strategies serve as a bridge between the implementation of trading strategies and the realization of trading objectives.

In-depth Exploration of Popular Trading Strategies

Fundamental Analysis: Strengths, Weaknesses, and Risk Management Techniques

Traders adopting Equity Trading Strategies and Stock Trading Methods often depend on fundamental analysis, which evaluates an asset based on its intrinsic value. This approach considers several factors such as financial health, industry position, market conditions, and even macroeconomic indicators to form investment decisions. These analysts often utilize Financial Markets Analysis to gain a broad perspective and pinpoint potential market opportunities.

However, no strategy is without its weaknesses. Fundamental analysis can be time-consuming and complex as it involves dissecting financial statements and staying abreast of market news. Furthermore, it often requires a long-term perspective, rendering it inadequate for short-term strategies like Day Trading Tactics or Forex Trading Plans.

When it comes to risk management within fundamental analysis, the focus is often on diversification. Building a varied portfolio reduces the impact of a potential downturn in a specific company or sector. Moreover, setting specific target prices and establishing stop-loss levels can help manage the risks involved in fundamental analysis.

Technical Analysis: Strengths, Weaknesses, and Risk Management Techniques

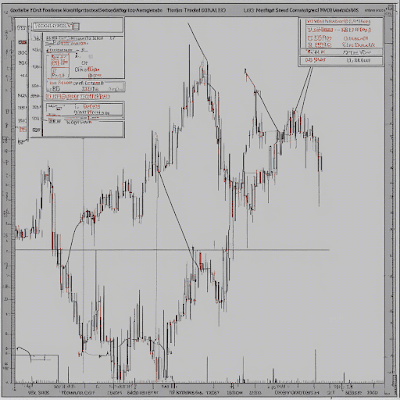

Technical analysis leverages price patterns and statistical trends derived from trading activity to predict future price movements. It plays an integral part in numerous Commodity Trading Strategies, Cryptocurrency Trading Tactics, and High-Frequency Trading Methods.

The primary strength of technical analysis lies in its applicability across different time frames and its quantitative nature. However, its downside is that it relies heavily on historical data and patterns, which may not always predict future trends accurately. Plus, the abundance of chart formations and indicators can often lead to confusion for new traders.

Nonetheless, technical analysis serves as a robust Risk Management Technique. It enables traders to define exact entry and exit points using stop losses, thus better controlling risk per trade. Also, through tools like moving averages or RSI, it provides clear indicators for potential trend reversals- an early sign for traders to manage their risk exposure effectively.

Evaluating the Application of Risk Management in Trading Strategies

Key Risk Management Strategies for Fundamental and Technical Analysis Trading

Efficient Risk Management Tactics permeate both fundamental and technical analysis trading. In fundamental analysis, traders practice Portfolio Diversification, a strategy that involves spreading the capital across various assets or asset classes to reduce potential losses. This method is prevalent in Options Trading Methods and Equity Trading Strategies, where the wide array of available securities allows for considerable diversification.

Additionally, strictly adhering to strict entry and exit points, often based on specific financial indicators or news events, is another risk management strategy in fundamental trading. Forex Trading Plans that operate on key economic reports exemplify this tactic.

In technical analysis, risk management often relies on Stop-loss and Take-profit Orders. By defining precise levels to cut losses or start taking profits, traders control the risk per trade. This forms the basis of many Day Trading Tactics and Swing Trading Techniques, where the quick pace of trading demands strict risk controls.

Another associated strategy is Position Sizing, where the amount of risk per trade is pre-determined, and the size of the position is adjusted accordingly. It's a common control approach in Cryptocurrency Trading Tactics and High-Frequency Trading Methods.

Practical Examples and Case Studies to Illustrate Risk Management in Action

Consider a case from Commodity Trading Strategies. A trader identifying a rising trend in oil prices based on Market Trend Analysis might decide to go long on crude oil. Here, the trader risks a significant portion of their capital, ignoring diversification rules, leading to a significant dent in their trading capital when an unexpected geopolitical event causes a sharp price drop.

This case illustrates the importance of diversification as a fundamental risk management principle. Whether the trader's analysis is based on Fundamental Analysis, Technical Analysis Techniques, or both, the application of sound risk management could have mitigated such losses, further emphasizing the critical interplay between Risk Management Tactics and Profitable Trading Plans.

The world of trading is characterized by potential profit and inevitable risk. However, with the right strategies and risk management principles, traders can navigate the Financial Markets Analysis more confidently and effectively, striving for consistent profitability in the long run.

Future Trends and Key Takeaways in Risk Management and Trading Strategies

From this analysis, it is clear that incorporating risk management in trading strategies is more than just a security measure; it's a critical component for long-term trading success. Whether one uses Stock Trading Methods, Forex Trading Plans, or Cryptocurrency Trading Tactics, understanding and applying risk management principles is key. All the techniques vary, but the underlying principle remains - never risk more than you are prepared to lose.

It's an age-old adage in trading, and for a good reason. Without proper risk control, a series of losses could decimate a trading account, regardless of the number of profitable trades. That's why even possession of the most proven trading strategy cannot guarantee success without a solid risk management approach in place.

Moving into the future, the field of risk management and trading strategies could increasingly lean on advancements in technology. Algorithmic Trading Strategies, for instance, are already being optimized with machine learning to predict market trends and manage risks more effectively. Similarly, new tools and platforms are providing traders with innovative ways to understand and analyze their risk exposure in real-time, allowing for informed, timely decisions.

Ultimately, in the era where financial markets are highly volatile, individual traders, financial institutions, and everyone in between continue to be bordered by risk. And as much as that risk comes with opportunities, a lack of comprehensive risk management strategies could potentially be catastrophic. Such insights prove the value of continuing efforts to refine and advance our understanding and application of risk management in trading practices.